How the India–UK FTA Opens New Doors for Indian Pharma & CDMOs

- Akshay Gautam

- Aug 2, 2025

- 11 min read

The India-UK Free Trade Agreement unlocks zero-duty access and faster approvals for Indian pharma exports, paving the way for deeper integration into the UK’s healthcare system. It positions Indian CDMOs and API manufacturers for exponential growth, fueling a new era of pharma collaboration and innovation.

1. Introduction

The India-UK Free Trade Agreement (FTA) is poised to transform bilateral trade and foster pharmaceutical collaboration. This agreement is a strategic economic catalyst, not just a diplomatic achievement, as the UK seeks to establish affordable, resilient, and diversified healthcare supply chains post-Brexit, and India strengthens its position as the "pharmacy of the world." India, a key pharmaceutical supplier to the UK, currently ranks third by volume and sixth by value, with exports reaching $651 million in FY 2022-23. This significant trade is poised for a 30-40% growth due to the India-UK Free Trade Agreement.

The agreement aims to boost trade by:

Eliminating Import Tariffs: Removing existing tariffs of up to 6%.

Reducing Non-Tariff Barriers: Addressing issues like duplicative product testing and regulatory delays.

Aligning Regulations: Harmonizing with the UK’s MHRA to speed up dossier evaluation and product registration.

This deal is a major advantage for Indian Contract Development and Manufacturing Organizations (CDMOs) and bulk drug/API manufacturers, particularly those with advanced capabilities. As the UK seeks to lessen its reliance on Chinese APIs, India is increasingly favored as a strategic source, with Pharmaexcil actively supporting Indian pharma companies in entering the UK market. Walter Healthcare stands ready to help pharma companies navigate the post-FTA world, offering tailored support in product development, contract manufacturing, and regulatory compliance for the UK and beyond. India’s pharma sector is entering a new era of global relevance and opportunity. And for those who are ready, the time to act is now.

This post provides a concise overview of the India-UK Free Trade Agreement (FTA), examining its implications, the role of Pharmaexil, the impact of FTA agreements on CDMO expansion and bulk drugs, and the functioning of the UK NHS.

2. What is FTA, and what provisions does it offer relevant to Pharma?

A Free Trade Agreement (FTA) is a treaty designed to eliminate or lower tariffs, import duties, and non-tariff barriers between participating countries. The India-UK FTA, which was finalized in 2024, is anticipated to significantly benefit Indian pharmaceutical companies, particularly those exporting formulations, APIs, and offering contract manufacturing services. This FTA improves India's access to the UK market by removing cost and regulatory hurdles, establishing a framework that enables Indian pharmaceutical manufacturers to increase exports, overcome entry barriers, and strengthen their engagement with UK healthcare stakeholders.

2.1. Tariff Elimination: Direct Cost Advantage

Current situations: Indian pharmaceutical exports to the UK, primarily finished formulations are currently subject to import duties up 6%. Post FTA benefits: Under the India-UK FTA, 100% of these duties will be eliminated, making Indian medicines zero-rated when entering the UK borders. This offers an immediate cost advantage to Indian exporters and strengthens their position in price-sensitive markets such as the UK National Health Service (NHS).

In FY 2022-23, India’s pharma exports to the UK stood at $651 million (₹5,440.85 Crores), with major contributions from generics and over-the-counter formulations. Industry analysts expect 30-40% growth in export value over the next 3-5 years as tariff elimination kicks in

Zero Duties: Unlocking a Major Cost Advantage for Indian Pharma

The Current Hurdle: Right now, Indian pharmaceutical exports to the UK, especially ready-to-use formulations, face import duties of up to 6%.

Why FTA is a game-changer: The India-UK Free Trade Agreement (FTA) is poised to be a pivotal development. By eliminating 100% of duties, it will enable Indian medicines to enter the UK market with zero-rated status. This offers an immediate and substantial cost advantage for Indian exporters, positioning them to excel in cost-sensitive markets such as the UK National Health Service (NHS).

The Growth Trajectory: In the fiscal year 2022-23, India's pharmaceutical exports to the UK reached $651 million, largely driven by robust sales of generics and over-the-counter medications. Industry experts project a 30-40% growth in export value over the next 3-5 years, primarily due to the elimination of tariffs.

2.2 Regulatory Simplification

Current MHRA Review Process: Indian companies submitting applications to the UK's drug regulator, the MHRA, can expect a standard processing time of 150 working days. This timeframe does not include additional time that may be required for clarifications or responses to post-submission queries.

FTA Advantage:

To expedite approvals and reduce redundant inspections, India should:

Recognize WHO-GMP and PIC/S (Pharmaceutical Inspection Co-operation Scheme) certifications.

Implement a Fast-Track Review Pathway for companies approved by the EU, USFDA, or WHO, potentially cutting review times by 40-50 days.

Foster cooperation between MHRA and CDSCO for streamlined document validation and dossier assessment.

Data Insight: Over 600 Indian pharma sites are WHO-GMP certified, and over 270 are MHRA-approved. This gives India an edge in leveraging the FTA’s provisions for faster approvals.

2.3 Catalyzing Pharma Export Growth: What’s in it for India?

The combined effect of duty-free access and fast-tracked approvals translates to massive potential growth for India’s pharmaceutical sector:

a. Export Volume & Value Growth

The removal of tariffs and simplified regulations enables Indian companies to expand their portfolios and ship larger volumes. Annual exports to the UK are projected to exceed $900 million by 2026, a significant increase from $651 million in 2023.

b. CDMO and Technology Transfer Expansion

Increased outsourcing from UK pharma companies to Indian CDMOs for formulation development, manufacturing, packaging, and R&D collaborations.

Reduced compliance burden for Indian CDMOs already adhering to global GMP standards due to the FTA.

c. Stronger NHS Integration

The NHS spends billions on medicines each year and is under increasing pressure to cut costs. Indian generics and APIs will be more price-competitive and supply-stable, helping the NHS reduce its reliance on Chinese suppliers.

3. Pharmaexcil’s role: Enabling Pharma’s global growth

As Indian pharmaceutical companies gear up to capitalize on the opportunities unlocked by the India-UK Free Trade Agreement (FTA), Pharmaexcil India's nodal agency for pharmaceutical exports, has emerged as a crucial enabler of global market success.

2,000+ Exporters Empowered

Pharmaexcil supports over 2,000 Indian pharmaceutical exporters by facilitating international trade, ensuring regulatory alignment, and providing crucial market intelligence. The organization is key in connecting Indian manufacturers with global buyers, offering compliance training, and organizing international trade events to enhance visibility and deal flow.

UK Market Focus: High Value, High Potential

In 2024, the UK pharmaceutical market reached a valuation of £48 billion, establishing itself as a leading global healthcare ecosystem. The increasing need for affordable generics, biosimilars, and APIs makes the UK an ideal export market for Indian manufacturers interested in long-term collaborations.

Strategic Trade Engagements: India-UK Business Forums

Pharmaexcil is actively paving the way for Indian companies to capitalize on FTA opportunities with the UK through a series of impactful initiatives:

India–UK Pharma Business Meet: These crucial gatherings in London and Hyderabad foster direct connections between Indian exporters and UK buyers, facilitating B2B matchmaking, insightful policy dialogues, and essential MHRA guidance sessions.

Regulatory Workshops: Experts from MHRA and CDSCO lead these workshops, providing invaluable insights on aligning documentation, achieving audit readiness, and navigating clinical trial regulations for a seamless entry into the UK market.

Furthermore, the Indian Foreign Trade Policy 2023 (FTP-2023) provides robust support, offering financial and logistical assistance to exporters participating in UK expos and trade delegations, ensuring Indian businesses are well-equipped to thrive.

4. CDMO Sector: Expansion Opportunities Under the FTA

The India-UK Free Trade Agreement presents a significant opportunity for Indian Contract Development and Manufacturing Organizations (CDMOs). Beyond opening doors for finished formulations and bulk drugs, this agreement is set to boost their global presence, particularly within the UK market.

Global CDMO Market Size: A Growing Opportunity

The global Contract Development and Manufacturing Organization (CDMO) market is projected to exceed $315 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.5%. This growth is primarily fueled by the increasing demand for outsourced R&D, formulation development, clinical trial manufacturing, and technology transfers. India is strategically positioned to capitalize on this expansion due to its extensive GMP-compliant infrastructure, cost efficiencies, and highly skilled scientific workforce, particularly as it gains streamlined access to regulated markets such as the UK.

The UK’s High Outsourcing Ratio

The UK pharmaceutical industry extensively utilizes external partners for drug development and manufacturing. Over 45% of UK pharmaceutical companies outsource formulation development and manufacturing to Contract Development and Manufacturing Organizations (CDMOs). This trend is particularly prevalent in the UK's biotech and small-cap pharma sectors, which are significant drivers of drug innovation. These companies favor agile CDMO partnerships to minimize overhead costs and accelerate their products' time-to-market.

UK Bio Industry Association (BIA) - With the FTA, Indian CDMOs gain a duty-free and regulatory-simplified pathway into the UK market.

Post-Brexit Shift in Supply Dependencies

Post-Brexit, the UK has been actively working to diversify away from EU-centric and China-dominated supply chains. India, already trusted globally for its WHO-GMP and MHRA-compliant sites, is emerging as a preferred alternative.

Over 270 Indian facilities are MHRA-approved, and more than 600 hold WHO-GMP certifications, providing instant credibility and fast-track acceptance for UK partnerships.

How Walter Healthcare Can Help

With UK pharmaceutical companies increasingly seeking cost-effective, high-quality development and manufacturing in the East, Indian CDMOs must be ready with ample capacity, coupled with precise regulatory and executional capabilities.

Walter Healthcare fuels the growth of Indian pharma clients

5. A competitive edge for Bulk Drugs and API Manufacturers

India is a global leader in supplying Active Pharmaceutical Ingredients (APIs) and bulk drugs, known for its capacity to produce large quantities at competitive international prices. The India-UK Free Trade Agreement (FTA) will further accelerate this growth by removing trade obstacles, streamlining regulations, and creating new opportunities for Indian manufacturers within the UK pharmaceutical supply chain.

5.1 India’s Bulk Drug & API Industry: By the Numbers

India is the world's third-largest producer of APIs (Active Pharmaceutical Ingredients), ranking behind China and the US. The country exports APIs to over 150 countries, including major markets like the UK, the US, Germany, Brazil, and Japan.

India boasts a robust manufacturing infrastructure for APIs, with:

Over 1,400 WHO-GMP (Good Manufacturing Practices) certified manufacturing units (CDSCO, 2023).

More than 500 facilities approved by leading international regulatory bodies such as the USFDA, EU-GMP, and MHRA.

Over 270 Indian sites specifically approved by the UK's MHRA (MHRA Public Database, 2024).

In terms of trade, India's API exports reached $5.39 billion in the fiscal year 2022-23

5.2 What the India–UK FTA Unlocks for API Manufacturers

The FTA directly removes long-standing bottlenecks for bulk drug exporters:

1. Elimination of Import Tariffs

Previously, Indian APIs faced import duties of up to 6% in the UK. However, the new FTA has eliminated these tariffs, leading to an immediate improvement in price competitiveness.

2. Faster Regulatory Approvals

The Free Trade Agreement (FTA) is set to foster regulatory alignment between India's CDSCO and the UK's MHRA. This alignment is expected to significantly benefit Indian sites that comply with WHO-GMP, ICH Q10, or EU-GMP standards, leading to expedited product registration processes. This is particularly crucial for Active Pharmaceutical Ingredients (APIs) intended for generics and NHS tenders in the UK.

3. Recognition of Quality Infrastructure

India's commitment to global pharmacovigilance and Good Manufacturing Practices (GMP) enhances trust among UK buyers. The Free Trade Agreement (FTA) promotes mutual recognition, thereby reducing the necessity for redundant testing and inspections.

5.3 Why the UK Needs Indian APIs

India's Role in Diversification: The UK government is actively seeking to diversify and strengthen its supply chains. India is well-positioned to meet these needs, offering significant scale, cost-effectiveness, and established quality in bulk drugs and API manufacturing.

5.4 How Walter Healthcare Supports API Exporters

Walter Healthcare provides end-to-end FTA-readiness and market-entry support to bulk drug manufacturers:

6. UK NHS accesses a new channel of growth

The UK's National Health Service (NHS), Europe's largest pharmaceutical purchaser, can now access high-quality, affordable Indian medicines directly. This is due to the India-UK Free Trade Agreement (FTA), which opens up cross-border pharmaceutical trade at a time when healthcare is being reshaped by rising demand and cost pressures.

6.1 NHS Procurement Size: A Market Worth Tapping

Annually, the NHS allocates over £17 billion to medicines across both primary and secondary care.

Given its substantial purchasing power, a mere 5-10% decrease in cost by opting for Indian generics or bulk imports could lead to savings of hundreds of millions of pounds.

NHS England’s Commercial Medicines Directorate, the NHS's centralized procurement arm, is actively seeking global sourcing strategies to improve access and affordability

6.2 Indian Drugs in the NHS Supply Chain

India is currently the third-largest supplier of generic medicines to the UK by volume.

Key Indian pharma companies such as Dr. Reddy’s, Cipla, Aurobindo, and Sun Pharma already supply products listed on the NHS Drug Tariff, including critical therapies like

Antihypertensive

Antibiotics

Diabetes medications

Oncology generics

Through the FTA, the elimination of import duties by up to 6% and expedited MHRA approval processes are expected to boost the presence of Indian pharmaceuticals in NHS procurement by 30-40% in the next 3-5 years.

6.3 The UK’s Aging Population: A Demand Driver

The UK Office for National Statistics (ONS) reports that more than 20% of the UK population is now 65 or older.

This demographic shift is dramatically increasing demand for chronic therapies in areas such as:

Cardiovascular disease

Diabetes

Cancer

Arthritis and musculoskeletal disorders

India's pharmaceutical industry is well-positioned to meet this demand affordably and efficiently, thanks to its established expertise in generic drugs for chronic conditions.

6.4 How the FTA Enhances NHS-India Collaboration

6.5 Walter Healthcare: Bridging NHS Opportunities

Walter Healthcare empowers Indian manufacturers to confidently and compliantly enter the NHS supply chain through:

NHS Tender Advisory: Expert guidance to identify and respond to NHS procurement opportunities.

Product Portfolio Review: Strategic selection of formulations for high-demand therapeutic areas.

UK Dossier Support: Seamless CTD preparation and alignment with MHRA submission requirements.

Local Partner Identification: Connecting Indian firms with the right UK-based distributors and marketing authorization holders (MAHs).

7. Walter Healthcare: Partner in FTA execution

With Indian pharmaceutical companies preparing to leverage the opportunities presented by the India-UK Free Trade Agreement (FTA), successful implementation will be key. Walter Healthcare provides specialized assistance to help you navigate the regulatory, technical, and commercial aspects with accuracy. Here's how we support your FTA strategy:

End-to-End CDMO Services for UK Market Entry

Walter Healthcare provides end-to-end support for UK-bound pharmaceutical projects, covering everything from formulation development to clinical trial supplies and large-scale manufacturing.

EU-GMP/UK-MHRA aligned CDMO capabilities.

Tech transfer and process optimization

Controlled manufacturing timelines for launch-readiness

Regulatory Navigation & Dossier Development

We specialize in compiling MHRA-compliant dossiers, ensuring quick approvals under new FTA-facilitated pathways.

CTD/eCTD preparation

MHRA fast-track submission alignment

Support for WHO-GMP and ICH Q10-based QMS documentation

API & Bulk Drug Supply Chain Enablement

Walter Healthcare helps Indian API producers capitalize on the UK’s post-Brexit diversification needs.

Sourcing partnerships with UK formulators

Commercial supply chain structuring under duty-free FTA terms

DMF (Drug Master File) readiness for UK buyers

Market Intelligence & NHS Integration Support

We decode the UK market’s procurement patterns and NHS demand trends, ensuring your portfolio is aligned with real-time, high-opportunity segments.

NHS Drug Tariff targeting

Tender support and local MAH partner identification

Ongoing FTA regulatory updates and training

Why Walter?

With a deep understanding of India’s regulatory ecosystem and the UK’s evolving healthcare needs, Walter Healthcare bridges ambition with execution, empowering Indian pharma to convert FTA access into long-term business growth.

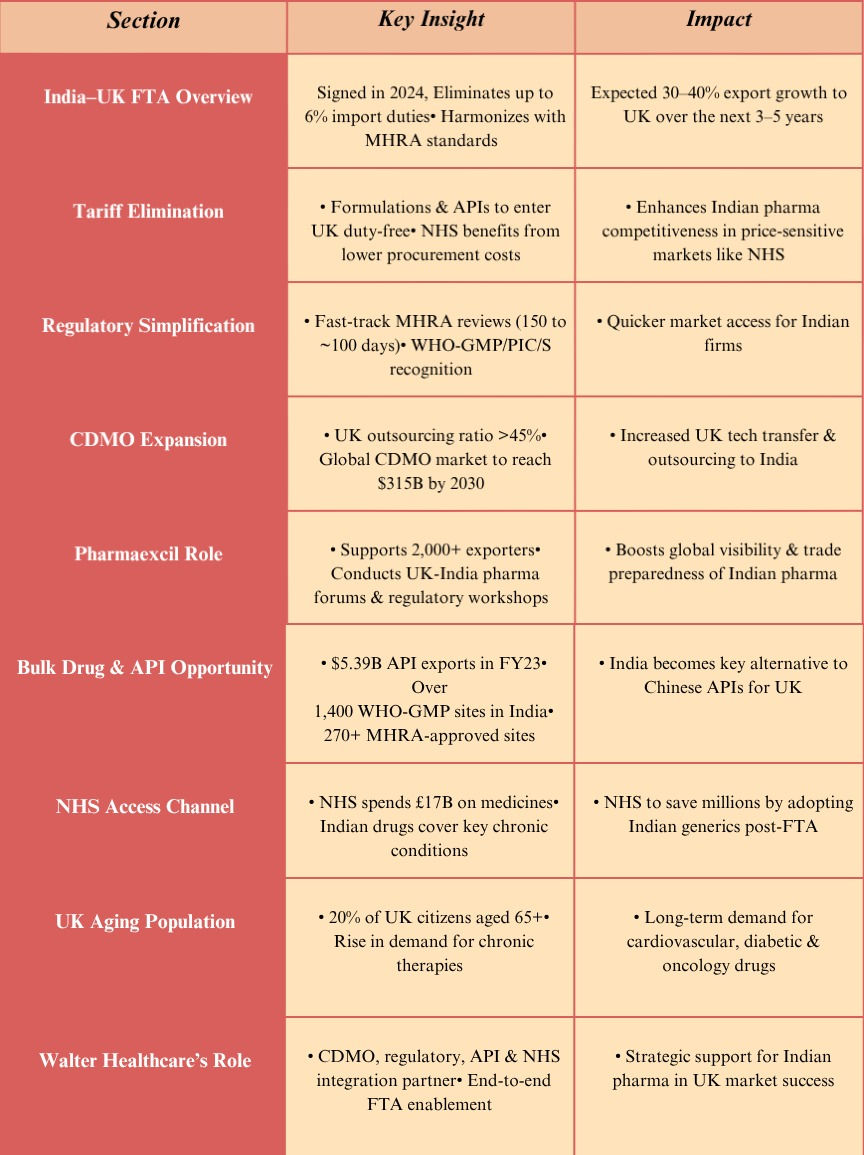

8. Insight Table

9. Conclusion

For companies ready to move fast, this is the time to turn policy into opportunity, and Walter is here to help you lead. The India-UK Free Trade Agreement isn't just a deal; it's a game-changer for India's pharmaceutical industry. By slashing tariffs (previously up to 6% on formulations) and fast-tracking regulatory approvals with the UK's MHRA, this FTA is opening massive doors. Indian pharma companies are set to dramatically boost exports, forge lucrative CDMO partnerships, and solidify their reputation as reliable, high-quality suppliers in a premium market. India already supplies the UK with a significant volume of medicines, hitting $651 million in FY 2022-23. This FTA is projected to ignite a 30-40% surge in that figure over the next few years.

With the UK NHS's colossal £17 billion annual drug procurement budget actively seeking to diversify and cut costs, India's prowess in bulk drug production, generics, and formulation development is perfectly aligned. Add to that the robust support from Pharmaexcil and a formidable compliance record over 600 WHO-GMP and 270+ MHRA-approved sites, and India's competitive edge is undeniable.

In this dynamic landscape, Walter Healthcare is your indispensable partner, offering strategic guidance across CDMO operations, regulatory approvals, dossier filings, and seamless UK market entry. For companies ready to seize this moment, now is the time to transform policy into an unparalleled opportunity, and Walter is poised to help you lead the way.

Great read! Very informative. Thanks!

Nice read. Thanks for such a detailed post.