Indian Pharmaceuticals Excelling Beyond Border

- Akshay Gautam

- Dec 31, 2025

- 8 min read

Pharma exports expected to double to $65 billion by 2030 with India’s rising role in supply-chain resilience, affordable generics, and high-value pharmaceutical manufacturing worldwide.

Introduction

The global healthcare landscape is being fundamentally shaped by the rise of India’s pharmaceutical industry. No longer just a regional player, India has firmly established itself as a pivotal force in ensuring access to medicine worldwide. Impressive figures underscore this influence. India’s pharmaceutical exports soared past USD 30 billion in the fiscal year 2024-25, a substantial jump from USD 22 billion in FY 2020-21. This sustained growth, achieving a strong Compound Annual Growth Rate (CAGR) of over 9%, is a testament to the world’s increasing trust in Indian-manufactured generics, vaccines, Active Pharmaceutical Ingredients (APIs), and complex formulations, all built on a foundation of consistent quality and cost efficiency.

Today, India serves over 200 countries and territories, providing nearly 20% of the world's generic medicine volume, cementing its position as the largest global supplier of generic drugs. The country's regulatory excellence is further confirmed by hosting the highest number of US FDA-approved manufacturing plants outside the United States. Looking ahead, the sector is on an ambitious path, with exports projected to double to USD 65 billion by 2030. This expansion signifies a strategic shift: from a volume-centric exporter to a value-driven global healthcare partner, perfectly aligned with rising global demand, the push for supply-chain diversification, and the increasing prevalence of chronic diseases. This expansion signifies a strategic shift: from a volume-centric exporter to a value-driven global healthcare partner, perfectly aligned with rising global demand, the push for supply-chain diversification, and the increasing prevalence of chronic diseases.

At Walter Healthcare, we are proud to be a driving force in this national mission. Our commitment to R&D, stringent quality control, and global partnerships ensures we are not just participants, but with time becoming leaders in delivering high-quality, affordable medicines to the world. This strategic rise makes the story of India's pharmaceutical sector essential reading for anyone tracking global health. In this blog post, we delve deeper into the factors driving this phenomenal growth, the crucial role of generic drugs, and what this expansion means for patients worldwide.

India’s Pharma Exports: The Road to USD 65 Billion by 2030

India’s ability to manufacture high-quality medicines at 30-40% lower costs than many developed markets positions it as a natural partner for sustainable healthcare delivery. India's pharma exports are projected to reach USD 60-65 billion by 2030, driven by increasing penetration into regulated markets and higher exports of complex generics, biosimilars, injectables, and specialty products.

This strategic expansion is underpinned by key global data:

Global healthcare spending is anticipated to exceed USD 10 trillion by 2030.

The global population aged 60+ will exceed 1.4 billion by 2030, escalating demand for chronic therapies.

Post-pandemic, governments are actively diversifying pharmaceutical supply chains.

Current Export Landscape: India as a Global Healthcare Backbone

India's pharmaceutical industry is the strategic backbone of global healthcare, enabling worldwide medicine access and public health through massive scale and financial impact.

Financial Powerhouse: Pharmaceutical exports are projected to exceed USD 30 billion for the fiscal year 2024-25.

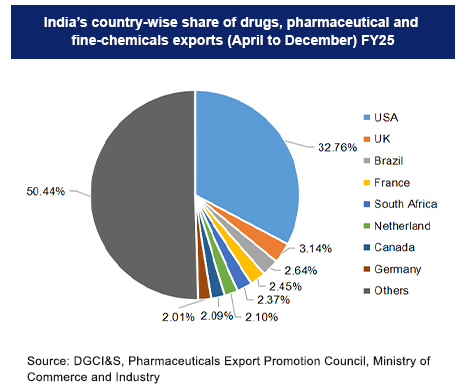

Key Global Markets: Exports go to over 200 countries, with 50% destined for highly regulated markets like North America and Europe.

A significant 34% of these exports are directed to the United States, making India an indispensable source for the largest healthcare market.

Approximately 19% market share is captured across Europe.

Our growth trajectory is accelerating across vital emerging economies, including Africa, Latin America, ASEAN, and CIS regions, strengthening healthcare systems in developing nations.

Indispensable to the US:

The US is the largest single destination, accounting for 34% of total pharma exports.

Indian companies supply a staggering 40% of all generic drugs consumed in the US.

UK Market Share:

Our products account for 25% of all medicines consumed in the United Kingdom. The DGFT and Pharmaexcil are engaging with the pharma industry on the India-UK Free Trade Agreement (FTA). The UK is a vital export market, and the FTA aims to unlock significant growth in the pharmaceutical sector. Key benefits include zero tariffs on generic medicines, enhanced supply chains, and reduced regulatory barriers, which will boost Indian competitiveness and accessibility. The FTA, a significant bilateral initiative, is expected to increase India's pharmaceutical exports to the UK by a significant margin, potentially reaching $1.5 billion in the first few years.

Beyond commercial success, India is a strategic guarantor of global public health.

World's Vaccine Hub: The nation is the world's largest vaccine producer, supplying an incredible 60-70% of all vaccines used by global immunization programs.

India’s commitment to quality and regulatory excellence solidifies its pivotal global position.

Regulatory Leadership (USFDA): Indian formulation companies hold 6,316 USFDA market authorizations as of April 2023, the highest compared to any other country.

Widespread Growth: Consistent performance and accelerating growth across emerging economies in Africa, Latin America, and ASEAN confirm India’s role as both a commercial powerhouse and a vital pillar of worldwide healthcare resilience.

Diverse Product Portfolio Strengthening Exports

India is not just an API supplier; it is a global hub for finished, patient-ready medicines. The overwhelming share of formulations and biologics demonstrates India’s transition from volume-driven exports to value-oriented, compliance-led pharmaceutical manufacturing, catering to highly regulated markets such as the USA, Europe, and Japan, as well as fast-growing emerging economies.

Export Composition

Drug Formulations & Biologicals: 75-80% The dominant export category comprises finished dosage forms such as tablets, capsules, injectables, biologics, and vaccines. This segment reflects India’s strength in large-scale, compliant manufacturing for regulated and semi-regulated markets.

Bulk Drugs (APIs) & Drug Intermediates: 15-20% APIs and intermediates form the backbone of global medicine production. India’s growing API ecosystem supports both domestic formulation needs and international supply chains.

Vaccines, Biosimilars & Specialty Products: 3-5% A high-impact segment with increasing strategic importance, driven by global immunization programs and rising demand for cost-effective biologics.

OTC, AYUSH, Surgicals & Others: 2-3% This includes herbal products, consumer healthcare items, and medical supplies, reflecting India’s diversification beyond conventional pharmaceuticals.

Key Growth Drivers of Pharmaceutical Growth Globally

1. Enduring Global Health Crisis Powers Demand

The world is facing a persistent and severe burden of chronic diseases—including cardiovascular conditions, diabetes, and various forms of cancer. Crucially, these diseases are responsible for over 70% of fatalities globally. This sobering statistic translates directly into an irreversible, long-term, and expanding need for high-quality, accessible pharmaceutical products, securing the foundation of sustained global demand.

2. The New Paradigm of Supply-Chain Resilience

In the aftermath of recent global disruptions, pharmaceutical purchasers worldwide are urgently shifting away from over-reliance on a single country for their critical supplies. This strategic imperative for diversification positions India as the leading and preferred 'Manufacturing Plus One' hub. India offers a robust, reliable, and scalable alternative, becoming indispensable in the new era of resilient global pharmaceutical sourcing.

3. Unrivaled Global Regulatory Endorsement

India's pharmaceutical industry operates with exceptional credibility in the world's most stringent markets. This trust is built on a strong regulatory foundation:

Over 600 Manufacturing Plants have been approved by the US FDA, the highest number outside the US.

Extensive approvals have been secured from major global bodies, including the UK MHRA, the European Medicines Agency (EMA), and WHO-GMP.

This deep-seated regulatory acceptance ensures seamless and continuous market access to the lucrative and highly regulated economies of North America and Europe.

4. Strategic Leap to High-Value Manufacturing

India's future export growth is no longer dependent on basic generics. Instead, it is driven by a strategic advancement up the pharmaceutical value chain, focusing on complex, sophisticated products:

Complex Generics and Injectables: Manufacturing complicated, high-margin finished dosage forms.

Specialty and Niche Formulations: Developing advanced delivery systems like modified-release products.

Regulated Market Specialization: Producing products specifically tailored to meet the exacting standards of the US and EU markets.

Digital and Compliance-Driven Operations: Implementing advanced digitalization to ensure world-class quality, traceability, and regulatory compliance across all manufacturing processes.

Government Policies Accelerating Pharma Exports

The Indian government has rolled out several strategic initiatives to bolster the pharmaceutical industry, aiming to enhance domestic manufacturing, foster innovation, and streamline regulatory processes. These initiatives position India as a global pharmaceutical hub.

The PLI scheme for pharmaceuticals is a landmark initiative designed to boost domestic manufacturing of high-value products and reduce dependence on imports of critical raw materials.

Financial Commitment: Over ₹15,000 crore has been allocated to this scheme, demonstrating a significant commitment to the sector's growth.

Core Focus Areas: The scheme provides incentives for the production of:

Key Starting Materials (KSMs)

Drug Intermediates (DIs)

Active Pharmaceutical Ingredients (APIs)

High-Value Formulations: This includes complex generics, patented drugs, and biologicals.

Resourcefulness: By incentivizing domestic production of APIs and KSMs, the PLI scheme mitigates supply chain risks, especially for essential medicines, and promotes 'Make in India' for the global market.

This long-term vision outlines the strategic roadmap for the Indian pharma sector, focusing on transforming it into a global leader powered by research and development.

Primary Goal: To achieve innovation-led exports, moving the industry from a volume-centric model to a value-centric model.

Strategic Strengthening:

Research & Development (R&D): Focus on developing cutting-edge drugs, therapies, and medical devices.

Regulatory Infrastructure: Streamlining processes to align with global best practices, facilitating faster market entry for innovative products.

Resourcefulness: This vision provides a clear, long-term strategic direction for pharmaceutical companies, encouraging investment in innovation and capacity building.

To improve the business environment and attract both domestic and foreign investment, the government has introduced several procedural reforms.

Expedited Clearances: Faster approvals for clinical trials, manufacturing licenses, and product registrations.

Digitalization: Implementation of digital regulatory submissions to enhance transparency, speed, and efficiency in interactions with the regulatory bodies.

Export Facilitation: Enhanced support for pharmaceutical exports through organizations like Pharmaexcil (Pharmaceuticals Export Promotion Council of India), which helps in market access and resolving trade-related issues.

Resourcefulness: These reforms reduce bureaucratic hurdles and the time-to-market for new drugs, making India a more attractive destination for pharmaceutical investment and manufacturing.

The CDSCO, India's national regulatory authority, is undergoing significant reform to ensure drug quality and safety standards are globally competitive.

Global Alignment: Focus on alignment with global regulatory standards (e.g., WHO-GMP, ICH guidelines) to enhance the credibility of Indian pharmaceuticals in international markets.

Enhanced Mechanisms: Modernizing and strengthening inspection and approval mechanisms to ensure rigorous quality control and efficient regulatory oversight.

Resourcefulness: A robust and globally aligned CDSCO is crucial for securing international trust in Indian-manufactured drugs, thereby opening doors to regulated markets like the US and Europe.

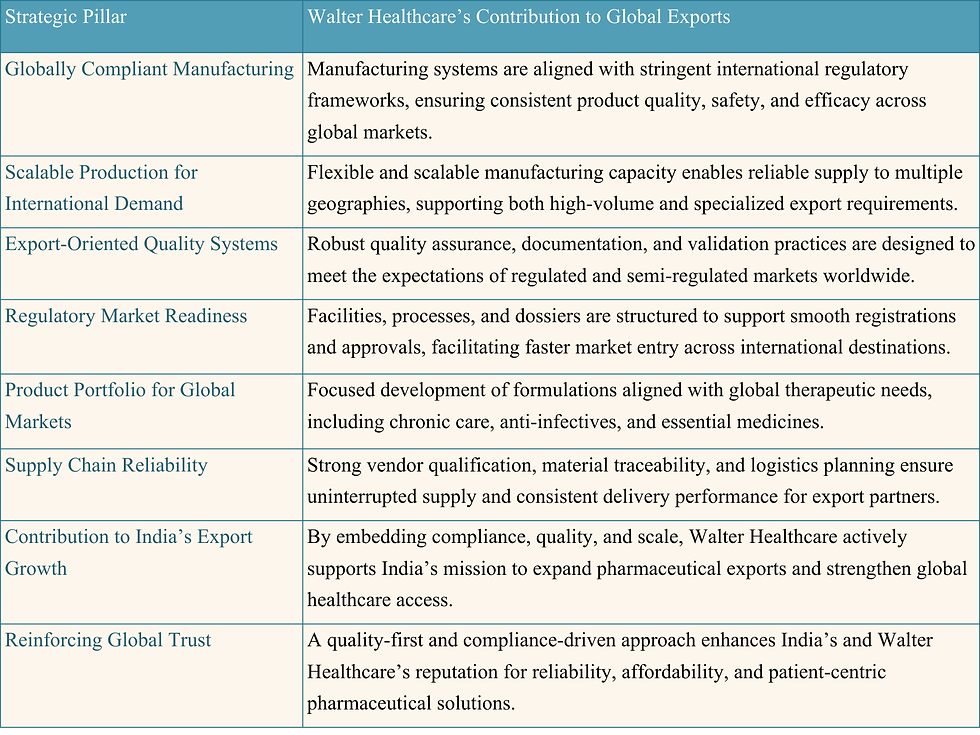

Walter Healthcare Contributing to India’s Export Growth

The rising global demand for affordable and high-quality pharmaceuticals positions India as a crucial player in the worldwide export market. Within this evolving ecosystem, Walter Healthcare is a committed partner in driving India’s global pharmaceutical aspirations. We achieve this through a focused strategy that prioritizes international standards and market readiness.

Conclusion

India's pharmaceutical journey is a global healthcare phenomenon, built on a foundation of scale, unwavering trust, affordability, and world-class regulatory standards. This evolution has transformed India from a key manufacturer into the world’s strategic healthcare partner, contributing a significant 20% of the world’s generic medicines and meeting 60-70% of global vaccine demand, serving over 200 countries. With exports already topping USD 30 billion and projected to soar to USD 65 billion by 2030, India's future is defined by high-value growth, complex therapies, and leadership in the world's most regulated markets. This acceleration is powered by unstoppable global demand, resilient supply chains, and forward-thinking government action. Policies like the PLI Scheme, Pharma Vision 2030, Ease of Doing Business reforms, and a strengthened CDSCO are collectively shifting India’s identity from a volume exporter to a high-value, innovation-led pharmaceutical superpower.

As this national momentum sweeps forward, Walter Healthcare is proud to be a meaningful contributor, aligning with the highest global regulatory standards, investing in compliant, scalable manufacturing, and maintaining an uncompromising focus on quality. By doing so, Walter Healthcare not only fuels India’s ambitious export goals but also champions global access to life-saving, affordable medicines. In a world facing intensifying healthcare challenges, India and committed partners like Walter Healthcare remain indispensable, dedicated to delivering safe, reliable, and accessible therapies worldwide, reinforcing India’s enduring identity as the true Pharmacy of the World.

Comments